can you go to jail for not paying taxes in south africa

Debt collectors have certain limitations which they cant violate. The court can now find you guilty of a tax crime even in cases of negligence or even in a case where the taxpayer may have made a mistake.

Photos Lady Diana Il Y A 18 Ans Elle Nous Quittait Lady Diana Princess Diana Photos Diana

You cannot go to jail for not paying your debts when there is a judgment against you.

. Yes you can go to prison for not paying taxes or filing your tax returns but the circumstances have to be pretty extreme for that to happen. Well explain in a moment. So to answer your question whether youll go to prison for debt in short NO.

Tax avoidance is not obtained by masking or changing the perceived nature of a transaction after the fact but by understanding the nature options and risks before the transaction is concluded. In a statement released on Thursday the revenue collector warned South African taxpayers to pay your taxes or pay the price after it had seen a. Up to 25 cash back I am not a South African Citizen.

Purposely failing to file the income tax return. However you can face jail time if you commit tax evasion tax fraud or do. Deliberately not paying or underpaying federal taxes can lead to a prison sentence but only if youve been charged with and convicted of a tax-related crime such as filing a fraudulent tax return or not filing a tax return at all.

Sars has the option to send an offender to jail for a period of up to 2 years. When Accounting Tax Advisers CPAs handle your affairs the question Can you go to jail for not paying taxes becomes a moot point. If you dont file youll face a failure-to-file penalty.

Posted 18 June 2021. In total you could end up paying up to 25 of the overall amount you owe. A new set of tax law amendments make it possible for the South African Revenue Service SARS to impose criminal sanctions on taxpayers who neglect their tax affairs.

False claims in tax deductions and tax credits. The answer is yes according to tax consultant Vincent Radebe. R500001R750000 R1650 2 of the amount above R500000.

If you failed to file your taxes in a timely manner then you could owe up to 5 for each month you didnt file. The United States doesnt just throw people into jail because they cant afford to pay their taxes. The penalty is 5 percent of your unpaid taxes for each month your tax return is late up to 25 percent.

When you purposely deceive the IRS to get out of paying taxes. In the past SARS needed to prove that a taxpayer had committed a tax crime willfully and without just cause but the legislation has just been changed. Plus if you file more than 60 days late youll pay a minimum of 135 or 100 percent of the taxes you owe whichever is less.

According to Section 126B of the NCA its unlawful for collection agencies to. It depends on the situation. The sheriff can however arrest you in the event that you have been.

There are different laws in South Africa that regulate the loan collection process. It means omitting or misrepresenting data sheets and even withholding crucial information that could unquestionably make a business or organization pay more taxes. In terms of the understatement penalty table the percentage of the.

The kind of loan that you owe determines if you will go to jail for not paying it or not. You can however be liquidated sequestrated an emoluments attachment order placed on your salary or your assets attached. Failure to report specific information could cost up to 520 per return.

This means tax payers could pay a penalty as high as 150 of the amount they understated in an attempt to avoid taxes. Some things that could potentially put you in jail for 1 to 5 years include. Janine Myburgh managing director of Myburgh Attorneys responds.

Negligent reporting could cost you up to 20 of the taxes you underestimated. Contact us at 630 932-9600 or through our website for more information on tax services by Accounting Tax Advisers CPAs.

Who Owns South Africa The New Yorker

Luxembourg Tax Authorities Issue Guidance On Administrative Fines Related To Tax Infractions And Procedures Applicable To Criminal Tax Offenses Ey Luxembourg

Owing Sars Money South African Revenue Service

Fabolous Emily B Mimi Faust Ty Young 2 Chainz And His Wife Kesha John Legend Kids Celebrity Dads Celebrities Male

Type Specimens Of Runaway Slaves And The Ads They Were Used To Depict Them Black History Facts African American History Black History

Identidad Digital Lytic2 Interroganteseducativos Special Needs Mom Tdcs Brain Stimulation

Marry Me Letters Video Outdoor Proposal Proposal Pictures Marriage Proposal Videos

How The Gupta Brothers Hijacked South Africa Using Bribes Instead Of Bullets Vanity Fair

Women S Rights Activist Is Taking On South Korea S President Yoon Suk Yeol Bloomberg

Racism And Apartheid In Southern Africa South Africa And Namibia

Authorities Have Jailed The Father Of A 4 Year Old South Jersey Boy Who Was Killed By A Self Inflicted Gunshot Earlier This Mon Jersey Boys 4 Year Olds Gunshot

Blac Chyna Has No Bank Account No Texts With Rob Hasn T Filed Taxes Since 2018

South Africa Detailed Assessment Report On Anti Money Laundering And Combating The Financing Of Terrorism In Imf Staff Country Reports Volume 2021 Issue 227 2021

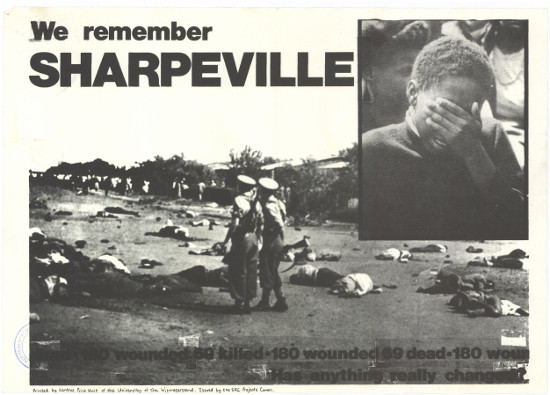

General South African History Timeline 1960s South African History Online